DISCLAIMER: This information is a summary only and is not intended to constitute tax advice. For tax advice consult a Tax Advisor only.

A lot has been said about how difficult it is to apply for the Rent Tax Credit. We’re going to try to demystify this process for you so you can apply for your own Rent Tax Credit. We’ll try to keep this guide updated. Best check the Revenue.ie website yourself though, before applying. Or consult a Tax Advisor.

Don’t forget also to download our free Do I qualify for Rent Tax Credit? cheatsheet in pdf format to determine whether or not you qualify for this Tax credit.

Do you qualify?

Download our do I qualify for Rent Tax Credit? cheatsheet.

Claiming your Rent Tax Credit

You’ll need to file your tax return before you can claim for the Rent Tax Credit.

Since you are filing your return anyway, you should also apply for a number of other Tax Credits, Reliefs and Allowances, to earn the highest Tax Refund possible.

Check out our Tax Refund Assessment tool to discover how much you may be owed by the taxman. Including for calculating your Rent Tax Credit amount due.

1. First, follow the guide to filing your Tax Return…

Follow our simple step-by-step guide to filing your own Tax Return (including a handy video as well as screenshots).

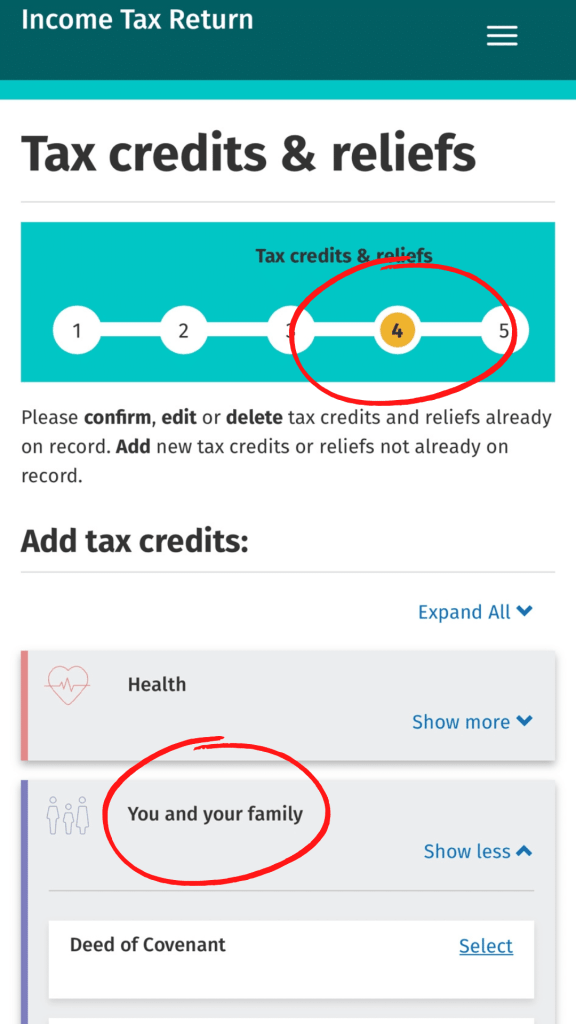

2. Enter your Tax credits & reliefs

After logging into myAccount and starting the Tax Return filing process. (see above). When you come to step 4 – Tax credits & reliefs. Follow the instructions and screenshots below to claim your Rent Tax Credit.

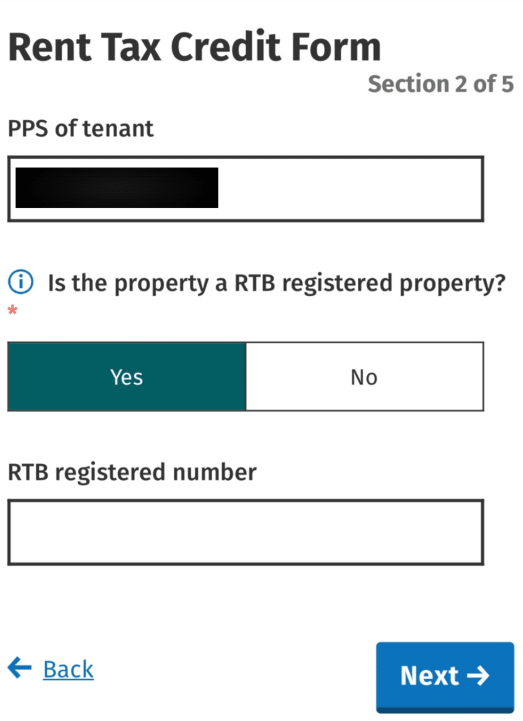

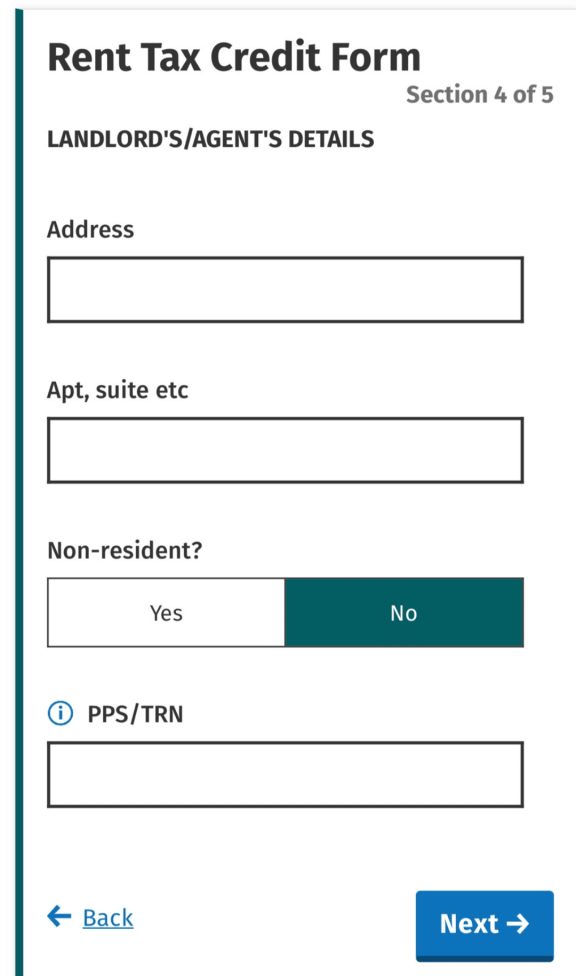

3. Fill out the Rent Tax Credit Form

The Rent Tax Credit form is where we submit our rent details and find out how much you’re owed in Tax Credit.

4. Finish your Tax Return

Finish submitting your Tax return using the Tax return guide. Congratulations, the Revenue Service will now credit your Tax bill. You’ll pay less Tax in the future.

Some notes:

Things to note regarding your Rent Tax Credit submission.

- The Rent Tax Credit is a Tax Credit, that means you have to have paid sufficient income tax to claim against ie. paid sufficient PAYE. Both USC and PRSI don’t count here as Tax paid. (See below)

- If you’ve made €3,750 in qualifying rent payments over the tax year and you’ve paid at least €3,750 PAYE income, you’ll be entitled to the full Rent Tax Credit of €750 for 2024 if you’re assessed as a single person. €1,500 if you’re assessed as a couple.

- You can claim your Rent Tax Credit for every year since its introduction in 2022.

- If you haven’t reached the €3,750 in rent paid you’ll still receive partial credit ie. 20% of your rent paid for the year.

- Your security deposit, bills for repairs or maintenance, your board, laundry, utilities or other services should not be included in your rent amount.

- You don’t need to upload documentation eg. Rent receipts to claim the Rent Tax Credit. You should keep these receipts anyway though in case you get audited by the taxman at some point.

- If a number of tenants pay the rent for a property, each individual or couple can claim the Rent Tax Credit for the rent they pay.

Calculating how much Rent Tax Credit you are due?

The amount of the credit is 20% of your rent payments in the year, up to a maximum credit of:

- €750 for an individual

- €1,500 for a couple who are jointly assessed for tax

If a smaller amount would reduce your income tax to zero, that amount is the maximum credit you can get. For 2022 and 2023, the credit was €500 for an individual and €1,000 for a couple.

Example:

Let’s calculate Ben’s Rent Tax Credit. We’ll use 3 key figures. Ben’s Rent Tax Credit will be the lower of these three figures.

| The total of all rent payments made by Ben of €10,000 at 20% | €2000 |

| The specified amount of €3,750 at 20% for single assessment | €750 |

| The amount required to reduce Ben’s PAYE Income Tax liability to nil | €16,000 |

Confused by the calculation?

Check out our Tax Refund Assessment tool to discover how much you may be owed by the taxman.