DISCLAIMER: This information is a summary only and is not intended to constitute tax advice. For tax advice consult a Tax Advisor only.

Claiming your Tax Refund is a simple and rewarding task in Ireland. We’ll show you how to claim your own Tax Refund in minutes using this simple step-by-step guide. You simply need to file your Tax Return.

NB: The taxman calculates your tax reliefs and your tax liabilities. They add any amount you may owe to your tax bill over the next year. Most employees are due a refund if they claim all their reliefs and credits properly.

Why you should file your Tax Return…

- Claim Tax Credits and Reliefs: Filing a tax return allows you to claim additional tax credits and reliefs that you might not automatically receive, such as medical expenses, tuition fees, or rent tax credit.

- Tax Refunds: If you have overpaid tax during the year, filing a return can help you claim a refund. This is common if your income fluctuates, you changed jobs, or had periods of unemployment.

- Accuracy of Tax Affairs: Filing a tax return ensures that your tax affairs are accurate and up-to-date. This helps avoid potential issues or discrepancies with the Revenue Commissioners.

- Self-Assessment and Compliance: By filing a return, you fulfill your legal obligations under self-assessment tax rules, ensuring compliance with Irish tax laws.

- Record Keeping: It provides an opportunity to review and update your financial records, ensuring all income and expenses are accurately recorded.

Gather your necessary info:

- Personal details (PPS number, address, etc.).

- Details of all income sources (rental income, investment income etc.).

- Records of any tax-deductible expenses (medical expenses, tuition fees, etc.).

- Receipts for any tax relief claims.

3 Steps to Filing your Tax Return in Ireland…

1. Sign in to myAccount online

- If you haven’t already, register for myAccount on the Revenue website. This will give you access to the necessary online services.

- Access the myAccount portal using your PPS number and password. Check your registration details match.

2. View your Preliminary End of Year Statement:

Your Preliminary End of Year Statement sets out your provisional tax position.

- After logging into myAccount, click on ‘Review your Tax’ for the relevant years.

- Select the relevant year to receive your Statement of Liability ie. a statement of how much you owe the taxman. We calculate how much the taxman owes you later.

- View your Preliminary End of Year Statement for your chosen tax year and ensure it’s correct.

3. Complete your Income Tax Return:

Now, you’re going to request tax reliefs and credits ie. amounts the taxman owes you.

- Click on ‘Complete your Income Tax Return’ shown on the screenshot directly above.

- The 5 remaining steps to complete your Income Tax return are shown now on myAccount.

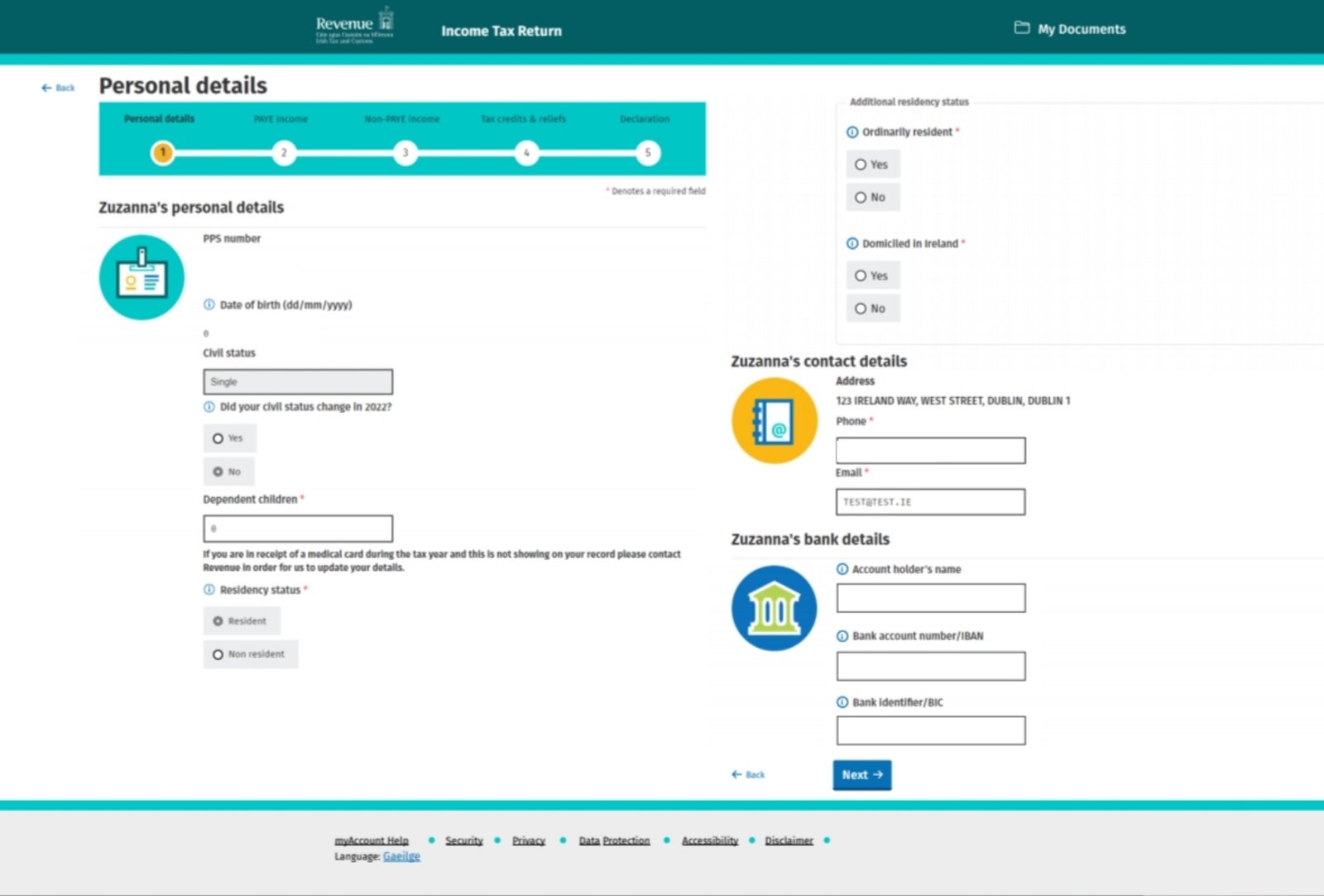

- Check your personal details are correct.

- Some details are prepopulated using information supplied by third-parties such as your employer and pension provider.

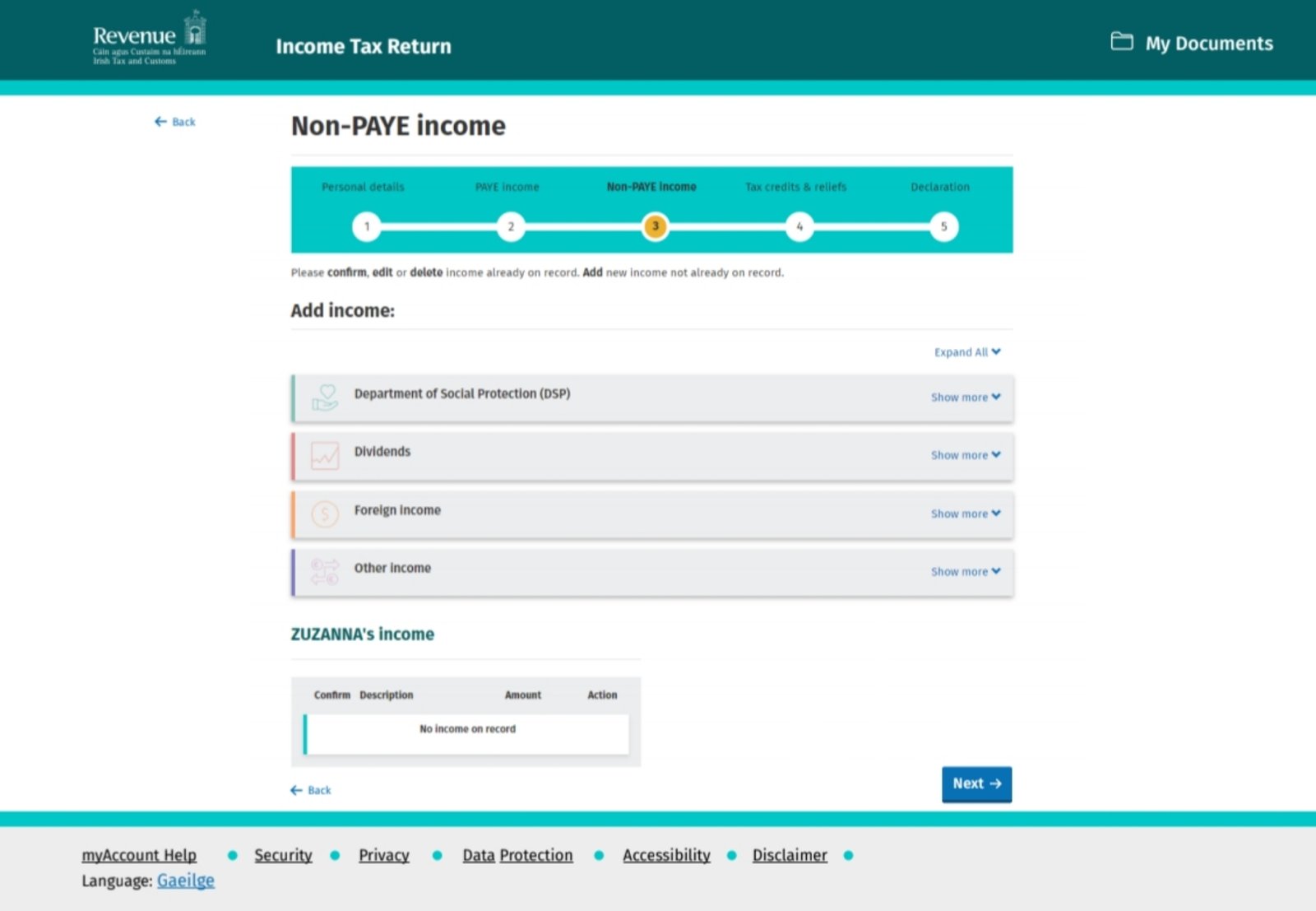

- Enter your non-PAYE tax income ie. any income you received that didn’t come from your job or jobs.

- Enter all the expenses you paid for which you are claiming tax reliefs or credits eg. Rent Tax Credit

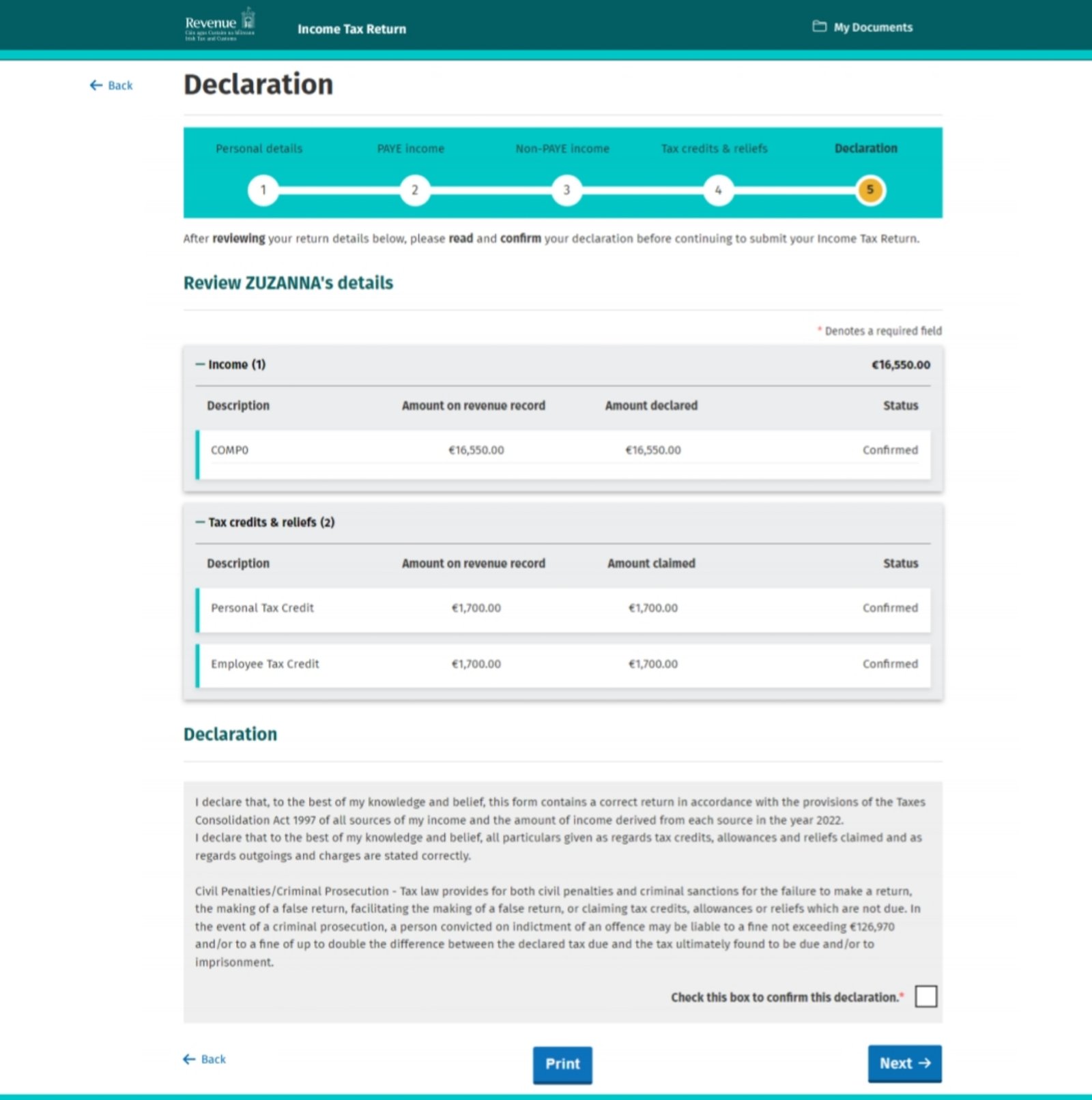

- Declare your data to be truthful and accurate.

- NB: It’s your responsibility to ensure that all data entered is correct.

- Sign in one more time so Revenue can be sure it’s you.

- The Thank You screen confirms that you’ve successfully submitted your tax return.

Confirmation and Follow-Up:

- Revenue may process your return immediately or contact you for additional information if needed.

- You can track the status of your return through the myAccount portal.

- If a refund is due, it will be processed and issued by Revenue, typically directly to your bank account.

Additional Tips

- Deadlines: Be aware of the filing deadlines to avoid penalties. The deadline for online returns is usually later than for paper returns.

- Assistance: If you are unsure about any part of the process, consider seeking assistance from a tax advisor or using the help resources available on the Revenue website.

By following these steps, a PAYE worker in Ireland can efficiently file their tax return, ensuring they maximize their entitlements and maintain accurate and compliant tax records.